Extensions/limitations of linear regression

Contents

2.3. Extensions/limitations of linear regression¶

Read then Launch

This content is best viewed in html because jupyter notebook cannot display some content (e.g. figures, equations) properly. You should finish reading this page first and then launch it as an interactive notebook in Google Colab (faster, Google account needed) or Binder by clicking the rocket symbol () at the top.

This section studies how to extend linear regression to more complicated types of variables and relationships, and the limitations of linear regression. We will use three datasets to illustrate these concepts:

The Advertising dataset that has been used in the previous sections.

The Credit dataset contains information about credit card holders. The goal is to predict the credit

Limitfor each card holder.The Auto dataset dataset contains information about the characteristics of cars. The goal is to predict the

mpg(miles per gallon) for a car based on its features likehorsepower,weightandacceleration. This dataset has also been used in the tutorial of Prerequisites.

You are encouraged to click the links to the datasets and explore the variables and understand their relationships.

2.3.1. Import libraries and load data¶

Get ready by importing the APIs needed from respective libraries.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.preprocessing import scale

from sklearn.linear_model import LinearRegression

from statsmodels.formula.api import ols

%matplotlib inline

Load the Advertising dataset dataset that we are already familiar with.

data_url = "https://github.com/pykale/transparentML/raw/main/data/Advertising.csv"

advertising_df = pd.read_csv(data_url, header=0, index_col=0)

Load the Credit dataset dataset, convert the Student2 category to numbers (‘0’ and ‘1’), and inspect the first three rows.

credit_url = "https://github.com/pykale/transparentML/raw/main/data/Credit.csv"

credit_df = pd.read_csv(credit_url)

credit_df["Student2"] = credit_df.Student.map({"No": 0, "Yes": 1})

credit_df.head(3)

| Income | Limit | Rating | Cards | Age | Education | Own | Student | Married | Region | Balance | Student2 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 14.891 | 3606 | 283 | 2 | 34 | 11 | No | No | Yes | South | 333 | 0 |

| 1 | 106.025 | 6645 | 483 | 3 | 82 | 15 | Yes | Yes | Yes | West | 903 | 1 |

| 2 | 104.593 | 7075 | 514 | 4 | 71 | 11 | No | No | No | West | 580 | 0 |

Load the Auto dataset datasets, ignore rows with missing values, and inspect the columns, counts and data types.

auto_url = "https://github.com/pykale/transparentML/raw/main/data/Auto.csv"

auto_df = pd.read_csv(auto_url, na_values="?").dropna()

auto_df.info()

<class 'pandas.core.frame.DataFrame'>

Index: 392 entries, 0 to 396

Data columns (total 9 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 mpg 392 non-null float64

1 cylinders 392 non-null int64

2 displacement 392 non-null float64

3 horsepower 392 non-null float64

4 weight 392 non-null int64

5 acceleration 392 non-null float64

6 year 392 non-null int64

7 origin 392 non-null int64

8 name 392 non-null object

dtypes: float64(4), int64(4), object(1)

memory usage: 30.6+ KB

2.3.2. Qualitative predictors¶

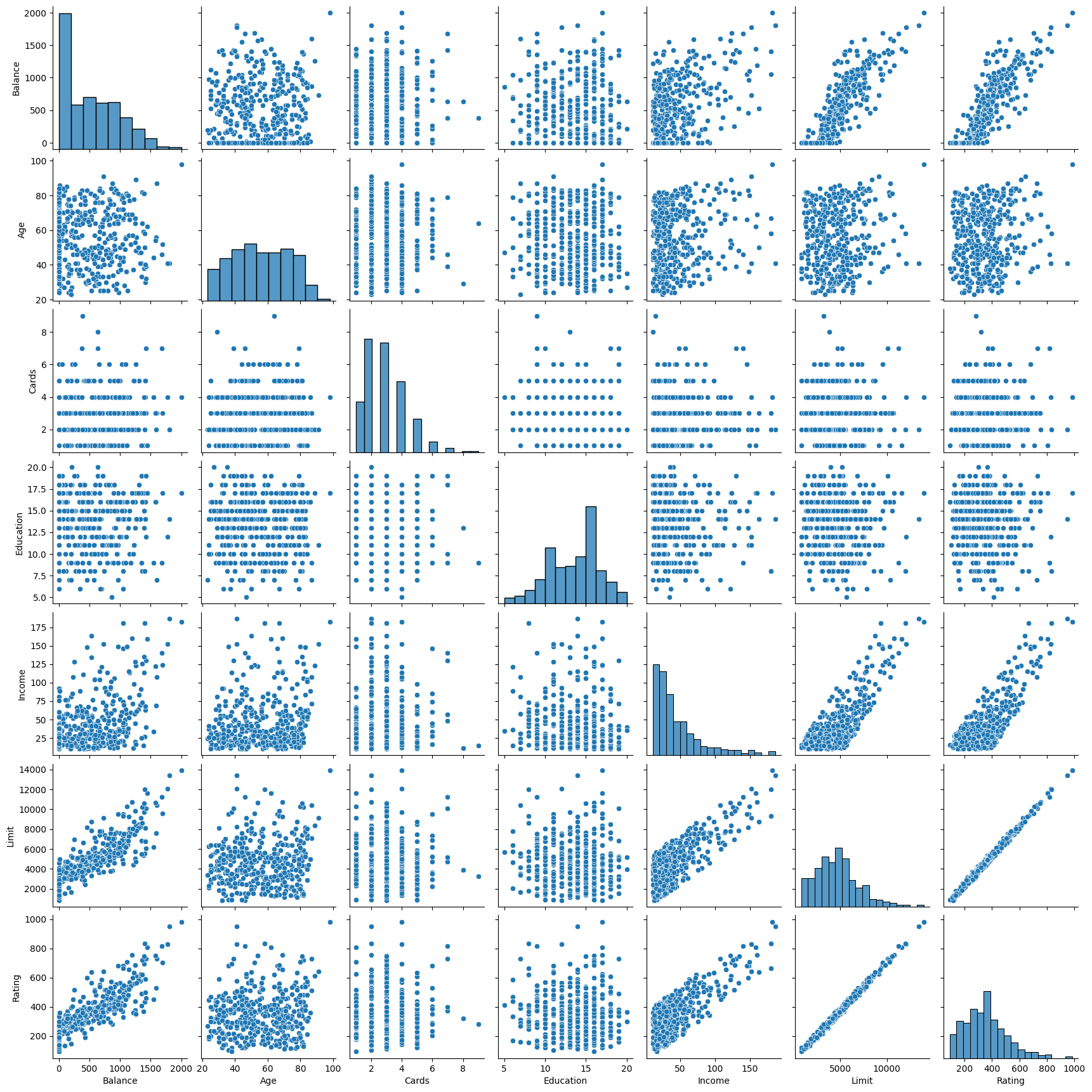

In the previous sections, the predictor variables are quantitative. Here, in the Credit dataset, the response is Balance (average credit card debt for each individual) and there are six quantitative predictors: Age , Cards (number of credit cards), Education (years of education), Income (in thousands of dollars), Limit (credit limit), and Rating (credit rating). The following code displays the pairwise relationships between these variables (Figure 3.6 in the textbook).

sns.pairplot(

credit_df[["Balance", "Age", "Cards", "Education", "Income", "Limit", "Rating"]]

)

plt.show()

However, in practice, predictor variables are not always quantitative. For example, in the Credit dataset, it also contains four qualitative (categorical) variables: Student (Yes or No), Own (Yes or No), Married (Yes or No), and Region (South, East, or West).

Predictors with only two levels

If a qualitative predictor has only two levels (possible values), then we can treat it as a quantitative variable, known as an indicator or dummy variable. For example, the Student variable has two levels: Yes and No. We can convert these levels to numbers, such as 1 and 0, and then treat the Student variable as a quantitative variable. This is called coding the qualitative variable, which is automatically done by the statsmodels library.

Run the following code to get the least squares coefficient estimates associated with the regression of Balance onto Own in the Credit dataset (Table 3.7 in the textbook).

est = ols("Balance ~ Own", credit_df).fit()

est.summary().tables[1]

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 509.8031 | 33.128 | 15.389 | 0.000 | 444.675 | 574.931 |

| Own[T.Yes] | 19.7331 | 46.051 | 0.429 | 0.669 | -70.801 | 110.267 |

The large \(p\) value above shows that there is no relationship between Balance and Own.

Predictors with more than two levels

When a qualitative predictor has more than two levels, we need to create additional dummy variables. For example, the Region variable has three levels: South, East, and West. We can create two dummy variables, South, and West, and then use these variables in the regression model. There will be always one fewer dummy variable than the number of levels in the qualitative variable. This is because the regression model can determine the value of the missing dummy variable. For example, if South is 0 and West is 0, then the individual must be from the East region. Again, such coding is automatically done by the statsmodels library.

Run the following code to get the least squares coefficient estimates associated with the regression of Balance onto Region in the Credit dataset (Table 3.8 in the textbook).

est = ols("Balance ~ Region", credit_df).fit()

est.summary().tables[1]

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 531.0000 | 46.319 | 11.464 | 0.000 | 439.939 | 622.061 |

| Region[T.South] | -12.5025 | 56.681 | -0.221 | 0.826 | -123.935 | 98.930 |

| Region[T.West] | -18.6863 | 65.021 | -0.287 | 0.774 | -146.515 | 109.142 |

The large \(p\)-values above show that there is no relationship between Balance and Region.

2.3.3. Extensions of linear regression¶

2.3.3.1. Interaction between variables¶

In the previous analysis of Advertising dataset, the predictor variables are assumed to be independent. However, this model may be incorrect. For example, radio advertising can increase the effectiveness of TV advertising, which is known as interaction effect in statistics. Consider the standard multiple linear regression with two variables

This model can be extended to include an interaction term between \(x_1\) and \(x_2\):

where \(\tilde{\beta}_1 = \beta_1 + \beta_3 x_2\) is the effective coefficient on \(x_1\), which can be viewed as another linear regression that regresses \(\tilde{\beta}_1\) onto \(x_2\). Then the association between \(y\) and \(x_1\) is no longer constant and depends on the value of \(x_2\). Similarly, the association between \(y\) and \(x_2\) is no longer constant and depends on the value of \(x_1\).

Run the following code for the Advertising data to get the least squares coefficient estimates associated with the regression of Sales onto TV and Radio, with an interaction term, TV \(\times\) Radio (Table 3.9 of the text book).

est = ols("Sales ~ TV + Radio + TV*Radio", advertising_df).fit()

est.summary().tables[1]

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 6.7502 | 0.248 | 27.233 | 0.000 | 6.261 | 7.239 |

| TV | 0.0191 | 0.002 | 12.699 | 0.000 | 0.016 | 0.022 |

| Radio | 0.0289 | 0.009 | 3.241 | 0.001 | 0.011 | 0.046 |

| TV:Radio | 0.0011 | 5.24e-05 | 20.727 | 0.000 | 0.001 | 0.001 |

The small \(p\)-value for the interaction term suggests that the true relationship is not additive and there is strong evidence of the association between Sales and the interaction between TV and Radio. Without including the interaction term, our understanding of the relationship between Sales and TV and Radio is not complete.

2.3.3.1.1. Interaction between qualitative and quantitative variables¶

The concept of interactions also applies to qualitative variables. In fact, sometimes an interaction between a qualitative variable and a quantitative variable has a particularly nice interpretation. For example, run the following code to predict Balance using the Income (quantitative) and Student (qualitative) variables, and compare the differences between including and excluding the interaction term between Income and Student.

est1 = ols("Balance ~ Income + Student2", credit_df).fit()

est2 = ols("Balance ~ Income + Income*Student2", credit_df).fit()

print("Regression 1 - without interaction term")

print(est1.params)

print("\nRegression 2 - with interaction term")

print(est2.params)

Regression 1 - without interaction term

Intercept 211.142964

Income 5.984336

Student2 382.670539

dtype: float64

Regression 2 - with interaction term

Intercept 200.623153

Income 6.218169

Student2 476.675843

Income:Student2 -1.999151

dtype: float64

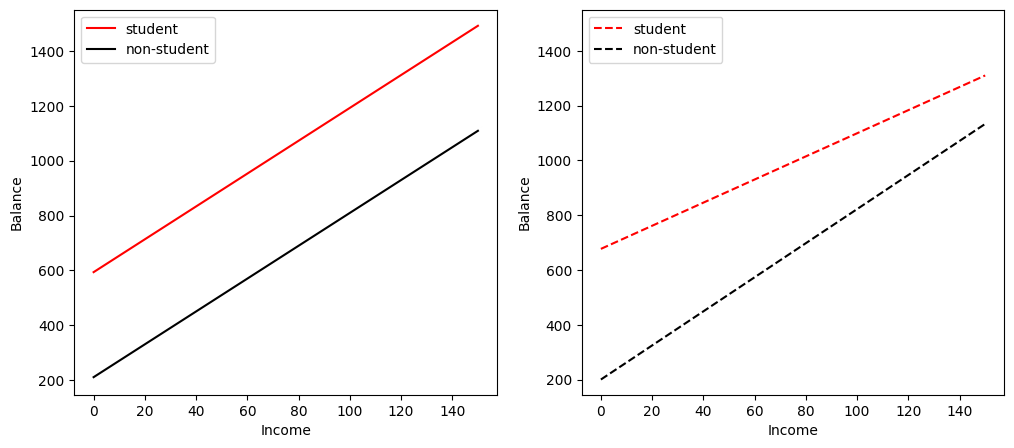

We can see that the interaction term between Income and Student affects the relationship between Balance and Student more than the relationship between Balance and Income. To have a closer look, let us visualise the relationship between Balance and Income for students and non-students separately (Figure 3.7 of the textbook).

# Income (x-axis)

regr1 = est1.params

regr2 = est2.params

income = np.linspace(0, 150)

# Balance without interaction term (y-axis)

student1 = np.linspace(

regr1["Intercept"] + regr1["Student2"],

regr1["Intercept"] + regr1["Student2"] + 150 * regr1["Income"],

)

non_student1 = np.linspace(

regr1["Intercept"], regr1["Intercept"] + 150 * regr1["Income"]

)

# Balance with interaction term (y-axis)

student2 = np.linspace(

regr2["Intercept"] + regr2["Student2"],

regr2["Intercept"]

+ regr2["Student2"]

+ 150 * (regr2["Income"] + regr2["Income:Student2"]),

)

non_student2 = np.linspace(

regr2["Intercept"], regr2["Intercept"] + 150 * regr2["Income"]

)

# Create plot

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(12, 5))

ax1.plot(income, student1, "r-", income, non_student1, "k-")

ax2.plot(income, student2, "r--", income, non_student2, "k--")

for ax in fig.axes:

ax.legend(["student", "non-student"], loc=2)

ax.set_xlabel("Income")

ax.set_ylabel("Balance")

ax.set_ylim(ymax=1550)

In the left figure without the interaction term between Income and Student, we see two (solid) parallel lines, one for students and one for non-students. The two lines have different intercepts but the same slope, indicating that a one-unit increase in Income will have the same effect on Balance for students and non-students, which is counterintuitive.

In the right figure with the interaction term between Income and Student, the two (dashed) lines are no longer parallel. We see that the slope of the line for students is flatter than that for non-students, indicating that a one-unit increase in Income will have a much smaller effect on credit card Balance for students than for non-students. This is consistent with our intuition.

2.3.3.2. Nonlinear relationships¶

In some cases, the true relationship between the response and the predictors may be nonlinear. Here we present a very simple way to directly extend the linear model to accommodate nonlinear relationships, using polynomial regression.

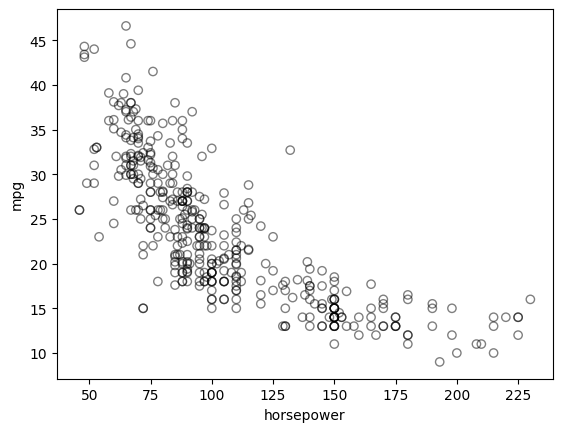

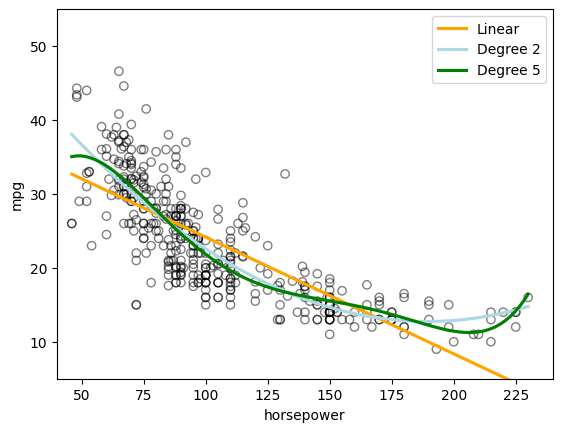

Run the following code to observe the relationship between mpg (gas mileage in miles per gallon) and horsepower.

plt.scatter(

auto_df.horsepower, auto_df.mpg, facecolors="None", edgecolors="k", alpha=0.5

)

plt.xlabel("horsepower")

plt.ylabel("mpg")

Text(0, 0.5, 'mpg')

The figure shows a strong relationship between mpg and horsepower, but it is clearly not linear. We can use a polynomial regression to fit a nonlinear model to the data. We can fit a polynomial regression of degree 2 (quadratic) to the data using the following regression:

Run the following code to display the relationship between mpg (gas mileage in miles per gallon) and \(\textrm{horsepower}^2\) as well as \(\textrm{horsepower}^5\) (Figure 3.8 of the textbook) for cars in the Auto dataset.

# With Seaborn's regplot() you can easily plot higher order polynomials.

plt.scatter(

auto_df.horsepower, auto_df.mpg, facecolors="None", edgecolors="k", alpha=0.5

)

sns.regplot(

x=auto_df.horsepower,

y=auto_df.mpg,

ci=None,

label="Linear",

scatter=False,

color="orange",

)

sns.regplot(

x=auto_df.horsepower,

y=auto_df.mpg,

ci=None,

label="Degree 2",

order=2,

scatter=False,

color="lightblue",

)

sns.regplot(

x=auto_df.horsepower,

y=auto_df.mpg,

ci=None,

label="Degree 5",

order=5,

scatter=False,

color="g",

)

plt.legend()

plt.ylim(5, 55)

plt.xlim(40, 240);

The above figure seems to suggest that a quadratic relationship between mpg and horsepower is more appropriate than a linear relationship.

In fact, this is still a linear model with \(x_1 = \textrm{horsepower}\) and \(x_2 = \textrm{horsepower}^2\). Run the following code to create a new predictor horsepower2 and inspect the Auto dataset.

auto_df["horsepower2"] = auto_df.horsepower**2

auto_df.head(3)

| mpg | cylinders | displacement | horsepower | weight | acceleration | year | origin | name | horsepower2 | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 18.0 | 8 | 307.0 | 130.0 | 3504 | 12.0 | 70 | 1 | chevrolet chevelle malibu | 16900.0 |

| 1 | 15.0 | 8 | 350.0 | 165.0 | 3693 | 11.5 | 70 | 1 | buick skylark 320 | 27225.0 |

| 2 | 18.0 | 8 | 318.0 | 150.0 | 3436 | 11.0 | 70 | 1 | plymouth satellite | 22500.0 |

Then run the following code to fit a linear regression model with mpg as the response and horsepower and horsepower2 as the predictors (Table 3.10 of the textbook).

est = ols("mpg ~ horsepower + horsepower2", auto_df).fit()

est.summary().tables[1]

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 56.9001 | 1.800 | 31.604 | 0.000 | 53.360 | 60.440 |

| horsepower | -0.4662 | 0.031 | -14.978 | 0.000 | -0.527 | -0.405 |

| horsepower2 | 0.0012 | 0.000 | 10.080 | 0.000 | 0.001 | 0.001 |

2.3.3.3. Limitations of linear regression¶

Every model will have some limitations, and linear regression is no exception. Here we briefly study two of the limitations of linear regression to show the possible complexities of real-world data. More limitations can be found in the textbook.

2.3.3.3.1. Nonlinearity of the Data¶

The linear regression model assumes that there is a “straight-line” relationship between the predictors and the response. If the true relationship is far from linear, then virtually all of the conclusions that we draw from the fit are questionable. In addition, the prediction accuracy of the model can be significantly reduced.

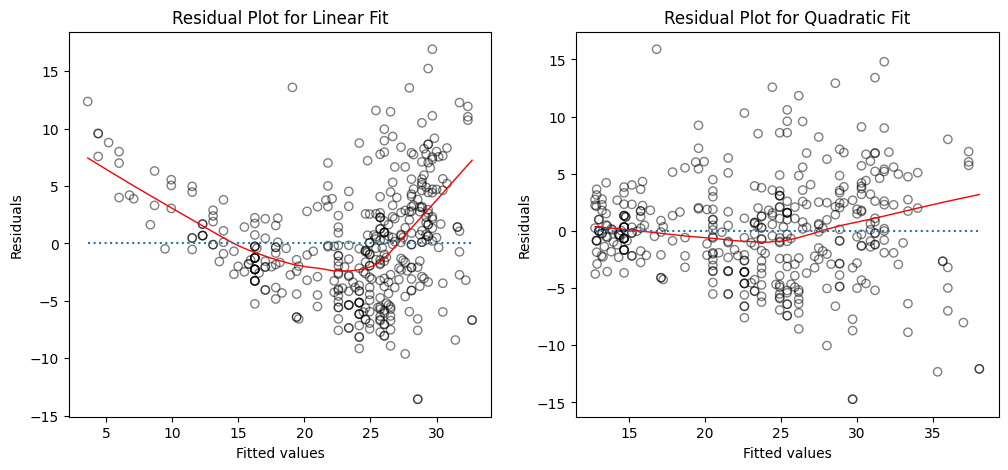

Run the following code to compare the differences in accuracy between a linear regression model and a quadratic regression model for regressing mpg onto horsepower.

Firstly, fitting a linear regression model and a quadratic regression model for regressing mpg onto horsepower and compute the residuals for each model.

regr = LinearRegression()

# Linear fit

X = auto_df.horsepower.values.reshape(-1, 1)

y = auto_df.mpg

regr.fit(X, y)

auto_df["pred1"] = regr.predict(X)

auto_df["resid1"] = auto_df.mpg - auto_df.pred1

# Quadratic fit

X2 = auto_df[["horsepower", "horsepower2"]].values

regr.fit(X2, y)

auto_df["pred2"] = regr.predict(X2)

auto_df["resid2"] = auto_df.mpg - auto_df.pred2

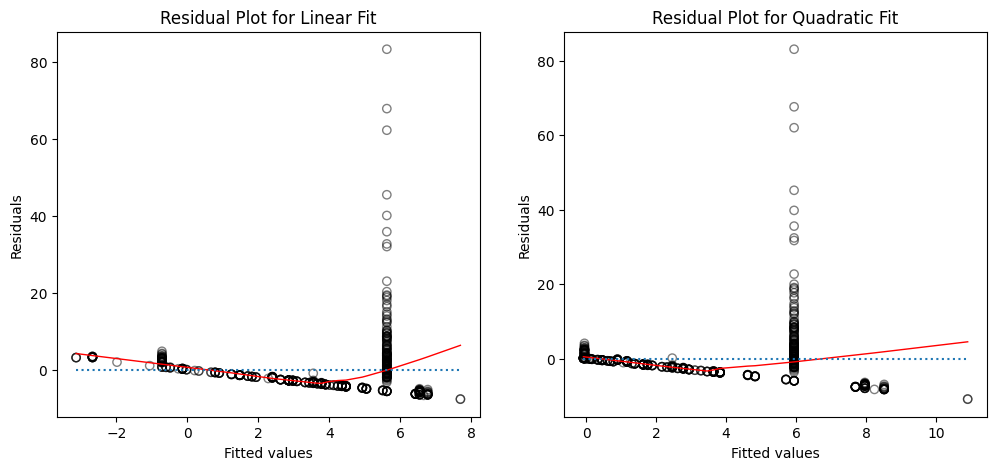

Create plots of the residuals for each model. What do you observe?

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(12, 5))

# Left plot

sns.regplot(

x=auto_df.pred1,

y=auto_df.resid1,

lowess=True,

ax=ax1,

line_kws={"color": "r", "lw": 1},

scatter_kws={"facecolors": "None", "edgecolors": "k", "alpha": 0.5},

)

ax1.hlines(

0,

xmin=ax1.xaxis.get_data_interval()[0],

xmax=ax1.xaxis.get_data_interval()[1],

linestyles="dotted",

)

ax1.set_title("Residual Plot for Linear Fit")

# Right plot

sns.regplot(

x=auto_df.pred2,

y=auto_df.resid2,

lowess=True,

line_kws={"color": "r", "lw": 1},

ax=ax2,

scatter_kws={"facecolors": "None", "edgecolors": "k", "alpha": 0.5},

)

ax2.hlines(

0,

xmin=ax2.xaxis.get_data_interval()[0],

xmax=ax2.xaxis.get_data_interval()[1],

linestyles="dotted",

)

ax2.set_title("Residual Plot for Quadratic Fit")

for ax in fig.axes:

ax.set_xlabel("Fitted values")

ax.set_ylabel("Residuals")

How to interpret the plots?

The left panel displays a residual plot from the linear regression of

mpgontohorsepoweron theAutodataset. The red line is a smooth fit to the residuals for identifying any trends in the residuals. Here, the residuals exhibit a clear U-shape, which provides a strong indication of nonlinearity in the data.The right panel displays the residual plot that results from the model contains a quadratic term. There appears to be little pattern in the residuals, suggesting that the quadratic term improves the fit to the data.

2.3.3.4. Collinearity¶

Collinearity refers to the situation in which two or more predictor variables are closely related to one another.

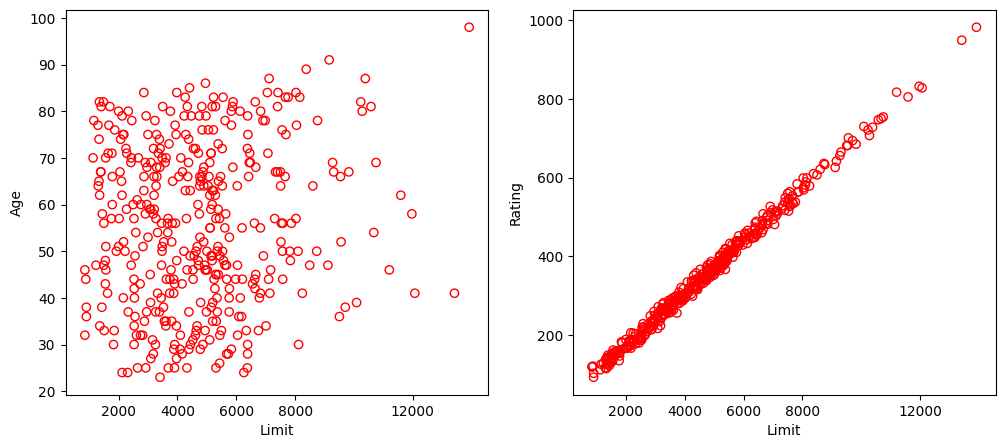

Run the following code to illustrate the problem of collinearity in the Credit dataset (Figure 3.14 of the textbook).

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(12, 5))

# Left plot

ax1.scatter(credit_df.Limit, credit_df.Age, facecolor="None", edgecolor="r")

ax1.set_ylabel("Age")

# Right plot

ax2.scatter(credit_df.Limit, credit_df.Rating, facecolor="None", edgecolor="r")

ax2.set_ylabel("Rating")

for ax in fig.axes:

ax.set_xlabel("Limit")

ax.set_xticks([2000, 4000, 6000, 8000, 12000])

In the left panel, the two predictors limit and age appear to have no obvious relationship. In contrast, in the right panel, the predictors limit and rating are very highly correlated with each other, and we say that they are collinear. In this context, limit and rating tend to increase or decrease together, it can be difficult to determine how each one separately is associated with the response balance.

Run the following code to learn the difficulties that can result from collinearity in the context of the Credit dataset.

y = credit_df.Balance

# Regression for left plot

X = credit_df[["Age", "Limit"]].values

regr1 = LinearRegression()

regr1.fit(scale(X.astype("float"), with_std=False), y)

print("Age/Limit\n", regr1.intercept_)

print(regr1.coef_)

# Regression for right plot

X2 = credit_df[["Rating", "Limit"]].values

regr2 = LinearRegression()

regr2.fit(scale(X2.astype("float"), with_std=False), y)

print("\nRating/Limit\n", regr2.intercept_)

print(regr2.coef_)

Age/Limit

520.0150000000001

[-2.29148553 0.17336497]

Rating/Limit

520.015

[2.20167217 0.02451438]

Create grid coordinates for plotting and then calculate RSS based on grid of coefficients

# grid coordinates

beta_age = np.linspace(regr1.coef_[0] - 3, regr1.coef_[0] + 3, 100)

beta_limit = np.linspace(regr1.coef_[1] - 0.02, regr1.coef_[1] + 0.02, 100)

beta_rating = np.linspace(regr2.coef_[0] - 3, regr2.coef_[0] + 3, 100)

beta_limit2 = np.linspace(regr2.coef_[1] - 0.2, regr2.coef_[1] + 0.2, 100)

X1, Y1 = np.meshgrid(beta_limit, beta_age, indexing="xy")

X2, Y2 = np.meshgrid(beta_limit2, beta_rating, indexing="xy")

Z1 = np.zeros((beta_age.size, beta_limit.size))

Z2 = np.zeros((beta_rating.size, beta_limit2.size))

limit_scaled = scale(credit_df.Limit.astype("float"), with_std=False)

age_scaled = scale(credit_df.Age.astype("float"), with_std=False)

rating_scaled = scale(credit_df.Rating.astype("float"), with_std=False)

# calculate RSS

for (i, j), v in np.ndenumerate(Z1):

Z1[i, j] = (

(y - (regr1.intercept_ + X1[i, j] * limit_scaled + Y1[i, j] * age_scaled)) ** 2

).sum() / 1000000

for (i, j), v in np.ndenumerate(Z2):

Z2[i, j] = (

(y - (regr2.intercept_ + X2[i, j] * limit_scaled + Y2[i, j] * rating_scaled))

** 2

).sum() / 1000000

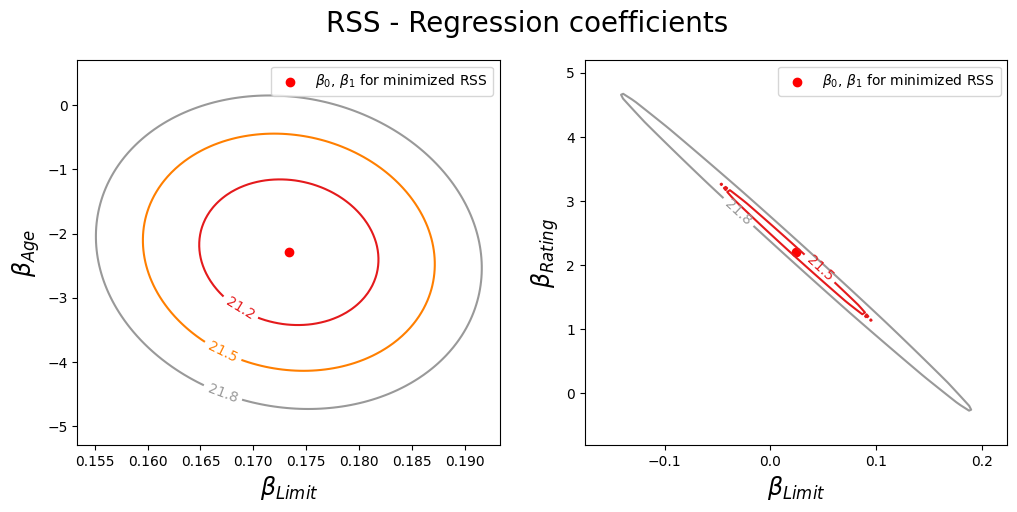

Plot the contours of the RSS with respect to the coefficients of the two linear regression models in 2D.

from matplotlib.pyplot import contour

fig = plt.figure(figsize=(12, 5))

fig.suptitle("RSS - Regression coefficients", fontsize=20)

ax1 = fig.add_subplot(121)

ax2 = fig.add_subplot(122)

min_RSS = r"$\beta_0$, $\beta_1$ for minimized RSS"

# Left plot

contour1 = ax1.contour(X1, Y1, Z1, cmap=plt.cm.Set1, levels=[21.25, 21.5, 21.8])

ax1.scatter(regr1.coef_[1], regr1.coef_[0], c="r", label=min_RSS)

ax1.clabel(contour1, inline=True, fontsize=10, fmt="%1.1f")

ax1.set_ylabel(r"$\beta_{Age}$", fontsize=17)

# Right plot

contour2 = ax2.contour(X2, Y2, Z2, cmap=plt.cm.Set1, levels=[21.5, 21.8])

ax2.scatter(regr2.coef_[1], regr2.coef_[0], c="r", label=min_RSS)

ax2.clabel(contour2, inline=True, fontsize=10, fmt="%1.1f")

ax2.set_ylabel(r"$\beta_{Rating}$", fontsize=17)

ax2.set_xticks([-0.1, 0, 0.1, 0.2])

for ax in fig.axes:

ax.set_xlabel(r"$\beta_{Limit}$", fontsize=17)

ax.legend()

Left: A contour plot of RSS for the regression of balance onto age and limit. The minimum value is well defined.

Right: A contour plot of RSS for the regression of balance onto rating and limit. Because of the collinearity, there are many pairs (\(\beta_{\text{Limit}}\) , \(\beta_{\text{Rating}}\)) with a similar value for RSS.

Collinearity reduces the accuracy of the estimates of the regression coefficients, it causes the standard error for \(\hat{\beta}_j\) to grow. In the presence of collinearity, we may fail to reject \(H_0\) : \(\hat{\beta}_j = 0\). This means that the power of the hypothesis test—the probability of correctly detecting a non-zero coefficient is reduced by collinearity.

Run the following code to compare the coefficient estimates obtained from two separate multiple regression models using statsmodels, where the first model is a regression of balance on age and limit, and the second model is a regression of balance on rating and limit.

est_age_limit = ols("Balance ~ Age + Limit", credit_df).fit()

est_age_limit.summary().tables[1]

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | -173.4109 | 43.828 | -3.957 | 0.000 | -259.576 | -87.246 |

| Age | -2.2915 | 0.672 | -3.407 | 0.001 | -3.614 | -0.969 |

| Limit | 0.1734 | 0.005 | 34.496 | 0.000 | 0.163 | 0.183 |

est_rating_limit = ols("Balance ~ Rating + Limit", credit_df).fit()

est_rating_limit.summary().tables[1]

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | -377.5368 | 45.254 | -8.343 | 0.000 | -466.505 | -288.569 |

| Rating | 2.2017 | 0.952 | 2.312 | 0.021 | 0.330 | 4.074 |

| Limit | 0.0245 | 0.064 | 0.384 | 0.701 | -0.101 | 0.150 |

The above generates Table 3.11 of the textbook.

How to interpret the results?

In the first regression, both age and limit are highly significant with very small \(p\)-values. In the second, the collinearity between limit and rating has caused the standard error for the limit coefficient estimate to increase by a factor of 12 and the \(p\)-value to increase to 0.701. In other words, the importance of the limit variable has been masked due to the presence of collinearity.

2.3.4. Exercise¶

1. All the following exercises involve the use of the Boston dataset. We will now try to predict per capita crime rate using the other variables in this dataset. In other words, per capita crime rate is the response, and the other variables are the predictors.

For each predictor, fit a simple linear regression model to predict the response. Don’t forget to handle any NULL values. Hint: See section 2.2.2.

# Write your code below to answer the question

Compare your answer with the reference solution below

from statsmodels.formula.api import ols

import pandas as pd

boston_url = "https://github.com/pykale/transparentML/raw/main/data/Boston.csv"

boston_df = pd.read_csv(boston_url).dropna()

models_a = [

ols(formula="crim ~ {}".format(f), data=boston_df).fit()

for f in boston_df.columns[1:]

]

for model in models_a:

print(model.summary().tables[1])

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 4.4537 0.417 10.675 0.000 3.634 5.273

zn -0.0739 0.016 -4.594 0.000 -0.106 -0.042

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -2.0637 0.667 -3.093 0.002 -3.375 -0.753

indus 0.5098 0.051 9.991 0.000 0.410 0.610

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 3.7444 0.396 9.453 0.000 2.966 4.523

chas -1.8928 1.506 -1.257 0.209 -4.852 1.066

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -13.7199 1.699 -8.073 0.000 -17.059 -10.381

nox 31.2485 2.999 10.419 0.000 25.356 37.141

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 20.4818 3.364 6.088 0.000 13.872 27.092

rm -2.6841 0.532 -5.045 0.000 -3.729 -1.639

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -3.7779 0.944 -4.002 0.000 -5.633 -1.923

age 0.1078 0.013 8.463 0.000 0.083 0.133

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 9.4993 0.730 13.006 0.000 8.064 10.934

dis -1.5509 0.168 -9.213 0.000 -1.882 -1.220

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -2.2872 0.443 -5.157 0.000 -3.158 -1.416

rad 0.6179 0.034 17.998 0.000 0.550 0.685

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -8.5284 0.816 -10.454 0.000 -10.131 -6.926

tax 0.0297 0.002 16.099 0.000 0.026 0.033

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -17.6469 3.147 -5.607 0.000 -23.830 -11.464

ptratio 1.1520 0.169 6.801 0.000 0.819 1.485

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 16.5535 1.426 11.609 0.000 13.752 19.355

black -0.0363 0.004 -9.367 0.000 -0.044 -0.029

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -3.3305 0.694 -4.801 0.000 -4.694 -1.968

lstat 0.5488 0.048 11.491 0.000 0.455 0.643

==============================================================================

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 11.7965 0.934 12.628 0.000 9.961 13.632

medv -0.3632 0.038 -9.460 0.000 -0.439 -0.288

==============================================================================

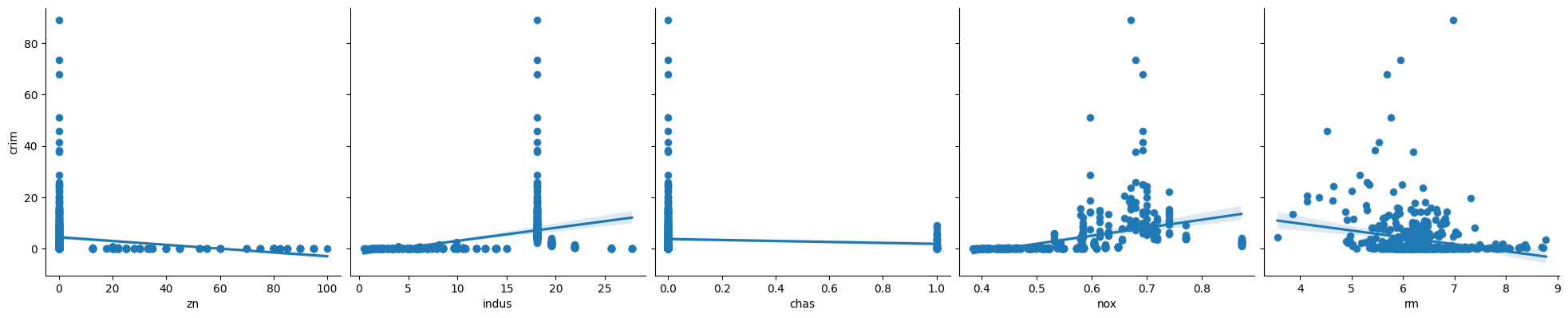

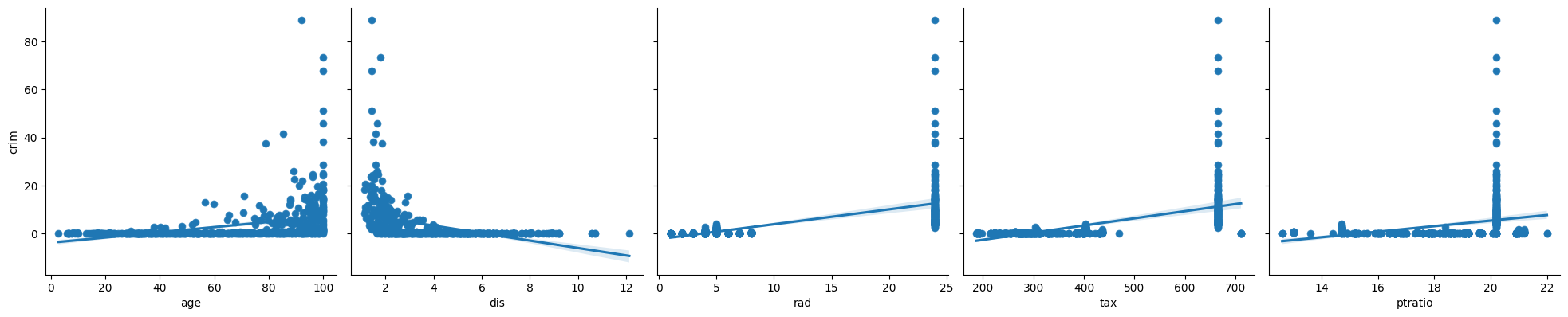

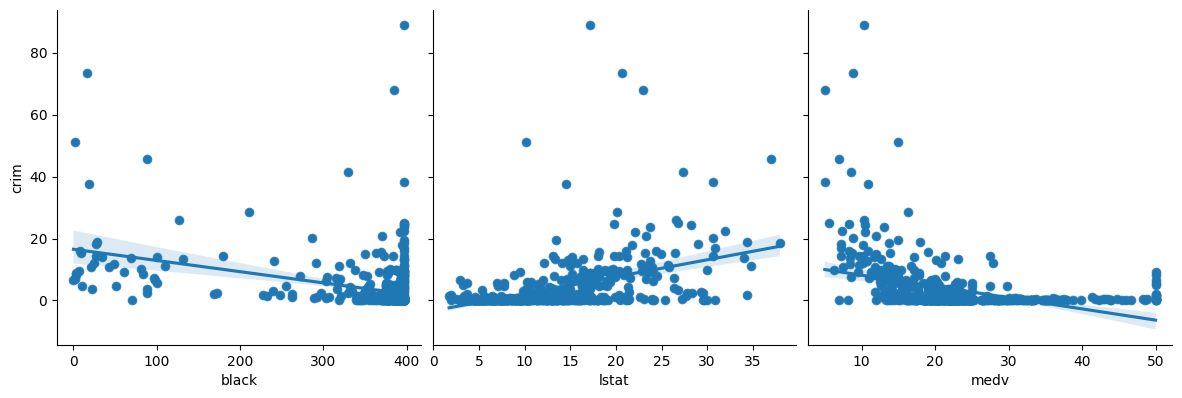

2. In which of the models is there a statistically significant association between the predictor and the response? Create some plots to back up your assertions.

# Write your code below to answer the question

Compare your answer with the reference solution below

print("p < 0.05\n")

for model in models_a:

if model.pvalues[1] < 0.05:

print(model.params[1:].index[0])

print("\np > 0.05\n")

for model in models_a:

if model.pvalues[1] > 0.05:

print(model.params[1:].index[0])

# zn, indu,s nox, rm, ag, dis, rad, tax, ptratio, black, lstat, medv are higly significant with very small p values.

def plot_grid(df, response, cols):

variables = df.columns.drop(response)

for i in range(0, len(variables), cols):

g = sns.pairplot(

df, y_vars=[response], x_vars=variables[i : i + cols], height=4

)

g.map(sns.regplot)

return

plot_grid(boston_df, "crim", 5)

p < 0.05

zn

indus

nox

rm

age

dis

rad

tax

ptratio

black

lstat

medv

p > 0.05

chas

3. Fit a multiple regression model to predict the response using all of the predictors. Hint: See section 2.3.3.

# Write your code below to answer the question

Compare your answer with the reference solution below

response = "crim"

predictors = boston_df.columns.drop(response)

f = "{} ~ {}".format(response, "+".join(predictors))

model_b = ols(formula=f, data=boston_df).fit()

model_b.summary()

| Dep. Variable: | crim | R-squared: | 0.454 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.440 |

| Method: | Least Squares | F-statistic: | 31.47 |

| Date: | Tue, 06 Feb 2024 | Prob (F-statistic): | 1.57e-56 |

| Time: | 20:20:16 | Log-Likelihood: | -1653.3 |

| No. Observations: | 506 | AIC: | 3335. |

| Df Residuals: | 492 | BIC: | 3394. |

| Df Model: | 13 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 17.0332 | 7.235 | 2.354 | 0.019 | 2.818 | 31.248 |

| zn | 0.0449 | 0.019 | 2.394 | 0.017 | 0.008 | 0.082 |

| indus | -0.0639 | 0.083 | -0.766 | 0.444 | -0.228 | 0.100 |

| chas | -0.7491 | 1.180 | -0.635 | 0.526 | -3.068 | 1.570 |

| nox | -10.3135 | 5.276 | -1.955 | 0.051 | -20.679 | 0.052 |

| rm | 0.4301 | 0.613 | 0.702 | 0.483 | -0.774 | 1.634 |

| age | 0.0015 | 0.018 | 0.081 | 0.935 | -0.034 | 0.037 |

| dis | -0.9872 | 0.282 | -3.503 | 0.001 | -1.541 | -0.433 |

| rad | 0.5882 | 0.088 | 6.680 | 0.000 | 0.415 | 0.761 |

| tax | -0.0038 | 0.005 | -0.733 | 0.464 | -0.014 | 0.006 |

| ptratio | -0.2711 | 0.186 | -1.454 | 0.147 | -0.637 | 0.095 |

| black | -0.0075 | 0.004 | -2.052 | 0.041 | -0.015 | -0.000 |

| lstat | 0.1262 | 0.076 | 1.667 | 0.096 | -0.023 | 0.275 |

| medv | -0.1989 | 0.061 | -3.287 | 0.001 | -0.318 | -0.080 |

| Omnibus: | 666.613 | Durbin-Watson: | 1.519 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 84887.625 |

| Skew: | 6.617 | Prob(JB): | 0.00 |

| Kurtosis: | 65.058 | Cond. No. | 1.58e+04 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.58e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

4. Which features seem to be statistically significant in this model?

# Write your code below to answer the question

Compare your answer with the reference solution below

print("p < 0.05\n")

model_b.pvalues[model_b.pvalues < 0.05]

# Only the resultent features seem to be statistically significant in this model.

p < 0.05

Intercept 1.894909e-02

zn 1.702489e-02

dis 5.022039e-04

rad 6.460451e-11

black 4.070233e-02

medv 1.086810e-03

dtype: float64

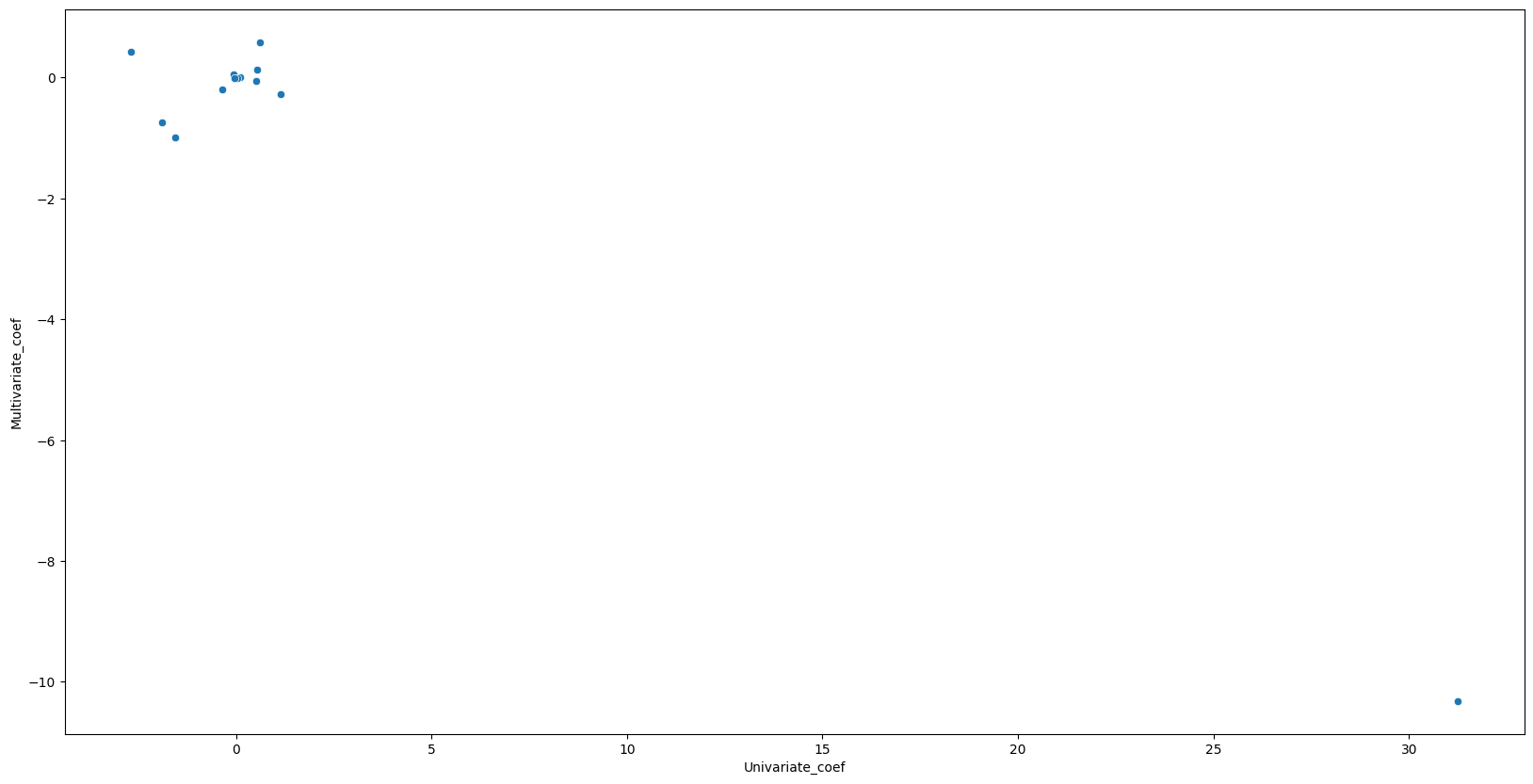

5. How do your results from Exercise 1 compare to your results from Exercise 3? Create a plot displaying the univariate regression coefficients from Exercise 1 on the \(x\)-axis, and the multiple regression coefficients from Exercise 3 on the \(y\)-axis. That is, each predictor is displayed as a single point in the plot. Its coefficient in a simple linear regression model is shown on the \(x\)-axis, and its coefficient estimate in the multiple linear regression model is shown on the \(y\)-axis.

# Write your code below to answer the question

Compare your answer with the reference solution below

# Get coefficients

univariate_params = pd.concat([m.params[1:] for m in models_a])

multivariate_params = model_b.params[1:]

df = pd.DataFrame(

{

"Univariate_coef": univariate_params,

"Multivariate_coef": multivariate_params,

}

)

print(df)

plt.figure(figsize=(20, 10))

ax = sns.scatterplot(x="Univariate_coef", y="Multivariate_coef", data=df)

# Multivariate regression found 5 of 13 predictors to be significnat where univariate regression found 12 of 13 significant. Multivariate regression seems to find significanlty less predictors to be significant.

Univariate_coef Multivariate_coef

zn -0.073935 0.044855

indus 0.509776 -0.063855

chas -1.892777 -0.749134

nox 31.248531 -10.313535

rm -2.684051 0.430131

age 0.107786 0.001452

dis -1.550902 -0.987176

rad 0.617911 0.588209

tax 0.029742 -0.003780

ptratio 1.151983 -0.271081

black -0.036280 -0.007538

lstat 0.548805 0.126211

medv -0.363160 -0.198887

6. Is there evidence of nonlinear association between any of the predictors and the response? To answer this question, for each predictor \(X\), fit a model of the form

Hint: See section 2.3.3.2.

# Write your code below to answer the question

Compare your answer with the reference solution below

models_d = [

ols(

formula="crim ~ {0} + np.power({0}, 2) + np.power({0}, 3)".format(f),

data=boston_df,

).fit()

for f in boston_df.columns[1:]

]

for model in models_d:

print(model.summary().tables[1])

print("\nFeatures with p < 0.05\n")

sig = pd.concat([model.pvalues[model.pvalues < 0.05] for model in models_d])

print(pd.DataFrame({"P>|t|": sig.drop("Intercept")}))

# There is evidence of a nonlinear association between the repsonse and INDUS, NOX, AGE, DIS, PTRATIO, medv

# There is evidence of a linear association between the response and ZN

===================================================================================

coef std err t P>|t| [0.025 0.975]

-----------------------------------------------------------------------------------

Intercept 4.8461 0.433 11.192 0.000 3.995 5.697

zn -0.3322 0.110 -3.025 0.003 -0.548 -0.116

np.power(zn, 2) 0.0065 0.004 1.679 0.094 -0.001 0.014

np.power(zn, 3) -3.776e-05 3.14e-05 -1.203 0.230 -9.94e-05 2.39e-05

===================================================================================

======================================================================================

coef std err t P>|t| [0.025 0.975]

--------------------------------------------------------------------------------------

Intercept 3.6626 1.574 2.327 0.020 0.570 6.755

indus -1.9652 0.482 -4.077 0.000 -2.912 -1.018

np.power(indus, 2) 0.2519 0.039 6.407 0.000 0.175 0.329

np.power(indus, 3) -0.0070 0.001 -7.292 0.000 -0.009 -0.005

======================================================================================

=====================================================================================

coef std err t P>|t| [0.025 0.975]

-------------------------------------------------------------------------------------

Intercept 3.7444 0.396 9.453 0.000 2.966 4.523

chas -0.6309 0.502 -1.257 0.209 -1.617 0.355

np.power(chas, 2) -0.6309 0.502 -1.257 0.209 -1.617 0.355

np.power(chas, 3) -0.6309 0.502 -1.257 0.209 -1.617 0.355

=====================================================================================

====================================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------------

Intercept 233.0866 33.643 6.928 0.000 166.988 299.185

nox -1279.3713 170.397 -7.508 0.000 -1614.151 -944.591

np.power(nox, 2) 2248.5441 279.899 8.033 0.000 1698.626 2798.462

np.power(nox, 3) -1245.7029 149.282 -8.345 0.000 -1538.997 -952.409

====================================================================================

===================================================================================

coef std err t P>|t| [0.025 0.975]

-----------------------------------------------------------------------------------

Intercept 112.6246 64.517 1.746 0.081 -14.132 239.382

rm -39.1501 31.311 -1.250 0.212 -100.668 22.368

np.power(rm, 2) 4.5509 5.010 0.908 0.364 -5.292 14.394

np.power(rm, 3) -0.1745 0.264 -0.662 0.509 -0.693 0.344

===================================================================================

====================================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------------

Intercept -2.5488 2.769 -0.920 0.358 -7.989 2.892

age 0.2737 0.186 1.468 0.143 -0.093 0.640

np.power(age, 2) -0.0072 0.004 -1.988 0.047 -0.014 -8.4e-05

np.power(age, 3) 5.745e-05 2.11e-05 2.724 0.007 1.6e-05 9.89e-05

====================================================================================

====================================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------------

Intercept 30.0476 2.446 12.285 0.000 25.242 34.853

dis -15.5544 1.736 -8.960 0.000 -18.965 -12.144

np.power(dis, 2) 2.4521 0.346 7.078 0.000 1.771 3.133

np.power(dis, 3) -0.1186 0.020 -5.814 0.000 -0.159 -0.079

====================================================================================

====================================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------------

Intercept -0.6055 2.050 -0.295 0.768 -4.633 3.422

rad 0.5127 1.044 0.491 0.623 -1.538 2.563

np.power(rad, 2) -0.0752 0.149 -0.506 0.613 -0.367 0.217

np.power(rad, 3) 0.0032 0.005 0.703 0.482 -0.006 0.012

====================================================================================

====================================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------------

Intercept 19.1836 11.796 1.626 0.105 -3.991 42.358

tax -0.1533 0.096 -1.602 0.110 -0.341 0.035

np.power(tax, 2) 0.0004 0.000 1.488 0.137 -0.000 0.001

np.power(tax, 3) -2.204e-07 1.89e-07 -1.167 0.244 -5.91e-07 1.51e-07

====================================================================================

========================================================================================

coef std err t P>|t| [0.025 0.975]

----------------------------------------------------------------------------------------

Intercept 477.1840 156.795 3.043 0.002 169.129 785.239

ptratio -82.3605 27.644 -2.979 0.003 -136.673 -28.048

np.power(ptratio, 2) 4.6353 1.608 2.882 0.004 1.475 7.795

np.power(ptratio, 3) -0.0848 0.031 -2.743 0.006 -0.145 -0.024

========================================================================================

======================================================================================

coef std err t P>|t| [0.025 0.975]

--------------------------------------------------------------------------------------

Intercept 18.2637 2.305 7.924 0.000 13.735 22.792

black -0.0836 0.056 -1.483 0.139 -0.194 0.027

np.power(black, 2) 0.0002 0.000 0.716 0.474 -0.000 0.001

np.power(black, 3) -2.652e-07 4.36e-07 -0.608 0.544 -1.12e-06 5.92e-07

======================================================================================

======================================================================================

coef std err t P>|t| [0.025 0.975]

--------------------------------------------------------------------------------------

Intercept 1.2010 2.029 0.592 0.554 -2.785 5.187

lstat -0.4491 0.465 -0.966 0.335 -1.362 0.464

np.power(lstat, 2) 0.0558 0.030 1.852 0.065 -0.003 0.115

np.power(lstat, 3) -0.0009 0.001 -1.517 0.130 -0.002 0.000

======================================================================================

=====================================================================================

coef std err t P>|t| [0.025 0.975]

-------------------------------------------------------------------------------------

Intercept 53.1655 3.356 15.840 0.000 46.571 59.760

medv -5.0948 0.434 -11.744 0.000 -5.947 -4.242

np.power(medv, 2) 0.1555 0.017 9.046 0.000 0.122 0.189

np.power(medv, 3) -0.0015 0.000 -7.312 0.000 -0.002 -0.001

=====================================================================================

Features with p < 0.05

P>|t|

zn 2.612296e-03

indus 5.297064e-05

np.power(indus, 2) 3.420187e-10

np.power(indus, 3) 1.196405e-12

nox 2.758372e-13

np.power(nox, 2) 6.811300e-15

np.power(nox, 3) 6.961110e-16

np.power(age, 2) 4.737733e-02

np.power(age, 3) 6.679915e-03

dis 6.374792e-18

np.power(dis, 2) 4.941214e-12

np.power(dis, 3) 1.088832e-08

ptratio 3.028663e-03

np.power(ptratio, 2) 4.119552e-03

np.power(ptratio, 3) 6.300514e-03

medv 2.637707e-28

np.power(medv, 2) 3.260523e-18

np.power(medv, 3) 1.046510e-12

7. Compare the differences between a linear regression model and a quadratic regression model for regressing ptratio onto crim. Does the quadratic term improves the fit to the data? Hint: See section 2.3.3.3.

# Write your code below to answer the question

Compare your answer with the reference solution below

from sklearn.linear_model import LinearRegression

import matplotlib.pyplot as plt

import seaborn as sns

regr = LinearRegression()

# Linear fit

X = boston_df.ptratio.values.reshape(-1, 1)

y = boston_df.crim

regr.fit(X, y)

boston_df["pred1"] = regr.predict(X)

boston_df["resid1"] = boston_df.crim - boston_df.pred1

boston_df["ptratio2"] = boston_df.ptratio**2

# Quadratic fit

X2 = boston_df[["ptratio", "ptratio2"]].values

regr.fit(X2, y)

boston_df["pred2"] = regr.predict(X2)

boston_df["resid2"] = boston_df.crim - boston_df.pred2

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(12, 5))

# Left plot

sns.regplot(

x=boston_df.pred1,

y=boston_df.resid1,

lowess=True,

ax=ax1,

line_kws={"color": "r", "lw": 1},

scatter_kws={"facecolors": "None", "edgecolors": "k", "alpha": 0.5},

)

ax1.hlines(

0,

xmin=ax1.xaxis.get_data_interval()[0],

xmax=ax1.xaxis.get_data_interval()[1],

linestyles="dotted",

)

ax1.set_title("Residual Plot for Linear Fit")

# Right plot

sns.regplot(

x=boston_df.pred2,

y=boston_df.resid2,

lowess=True,

line_kws={"color": "r", "lw": 1},

ax=ax2,

scatter_kws={"facecolors": "None", "edgecolors": "k", "alpha": 0.5},

)

ax2.hlines(

0,

xmin=ax2.xaxis.get_data_interval()[0],

xmax=ax2.xaxis.get_data_interval()[1],

linestyles="dotted",

)

ax2.set_title("Residual Plot for Quadratic Fit")

for ax in fig.axes:

ax.set_xlabel("Fitted values")

ax.set_ylabel("Residuals")

# The left plot displays a residual plot from the linear regression of ptratio onto crim on the Boston dataset.

# The red line is a smooth fit to the residuals for identifying any trends in the residuals.

# Here, the residuals exhibit a tendency of U-shape, which provides a strong indication of nonlinearity in the data.

# The right panel displays the residual plot that results from the model contains a quadratic term.

# There appears to be little pattern in the residuals, suggesting that the quadratic term improves the fit to the data.